In case you’ve somehow missed it, we’re in an election year… and it’s definitely not a normal one. We’ve experienced far more craziness than you’d expect…

We’ve got one candidate running for a non-consecutive second term – a victory here would be something Americans haven’t seen since Grover Cleveland’s win… in 1893.

We’ve seen one candidate withdraw from the running, leaving his VP to be the presumptive nominee and putting one of America’s two major political parties in a state of chaos.

And to top it all off (even though we’re only about halfway to the end), we’ve seen an assassination attempt on one candidate that proved a very close call.

Needless to say, all the ordinary volatility that comes with an election year has been cranked up to 11 in 2024. And I don’t see it calming down in 2028, 2032, or 2036…

But the smart Americans are tuning out of politics altogether and making money… no matter who wins…

Because no matter what the news media tells you, regardless of who wins in November, the world will keep spinning and that lucky old sun will just keep rolling around in heaven.

The only choice you really have to make is whether or not you’d like to be filthy rich come the new year or not…

And if you’d like to make the smart choice, just read on…

Ignore the Noise, Make Some Money

Edgar Allan Poe once wrote, “Believe half of what you see and nothing of what you hear.”

That’s precisely what you ought to do during the election cycle. As crazy as the election is this year, the mainstream media is still pumping up the political drama during election season nonstop. They pollute the airwaves with sensationalized headlines and exaggerations. Trump said this, Biden did this, some guy on X or TikTok had an opinion…

It’s a lot of noise. This election, I’m voting for massive trading profits. And to do that, we’re going to take advantage of everyone stuck in the election rat race the news media creates.

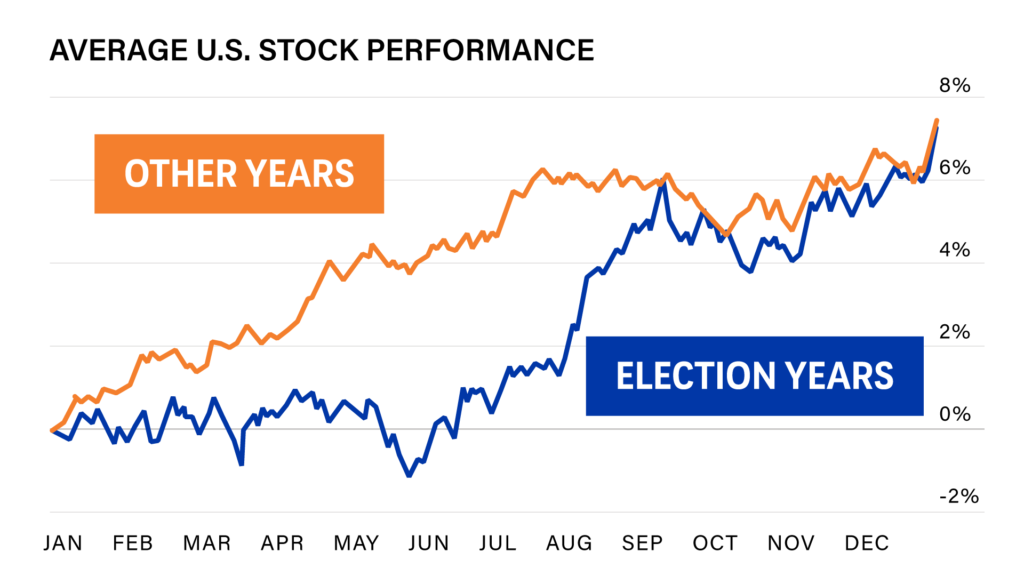

Largely because of all the sensationalist headlines that come out as an election ramps up, the market typically performs better during the second half of election years. As sentiment changes, the market reacts.

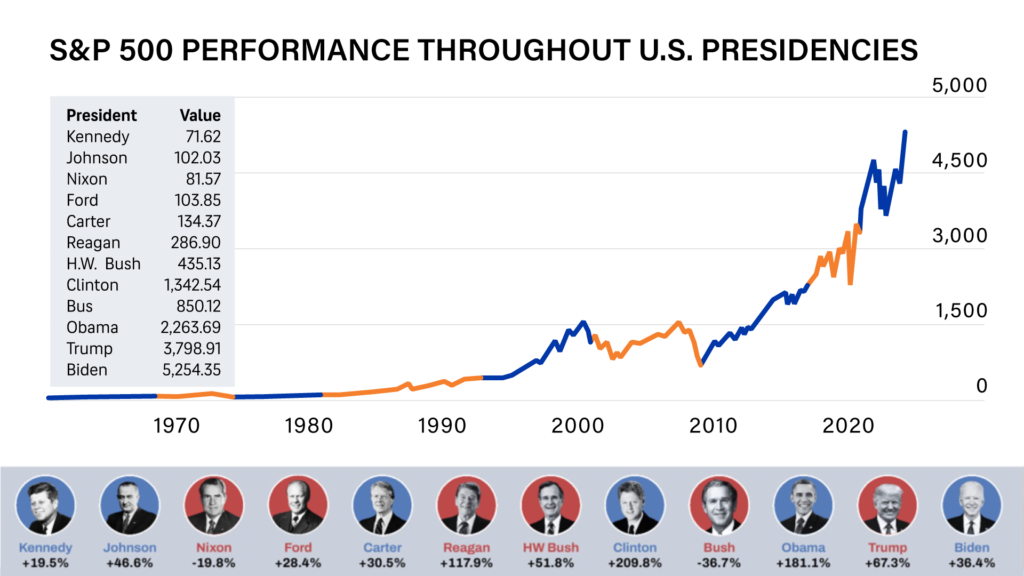

A Cornell University study showed that investors systematically alter their holdings of certain types of stocks because of changes in the political climate. For example, tobacco and lab equipment stocks do better under Republicans, while real estate and construction stocks do better under Democrats.

The market reacts and the market prevails no matter who is in the White House.

That’s precisely why you should NOT take your money out of the market because of political fears or volatility. In fact, for traders, volatility is a friend. If the market is moving fast, we can make money. It doesn’t matter what direction those moves are in.

The bottom line is this: Investors overreact all the time during the election season. And when they do, we need to be ready to profit.

Here’s how we do that…

Win the Lotto… Day After Day

My favorite trade for an election year is something I call the Lotto Trade.

But, while this trade is speculative and not something you should ever put more than you can afford to lose in, we aren’t relying on lady luck to win, we’re making our own luck…

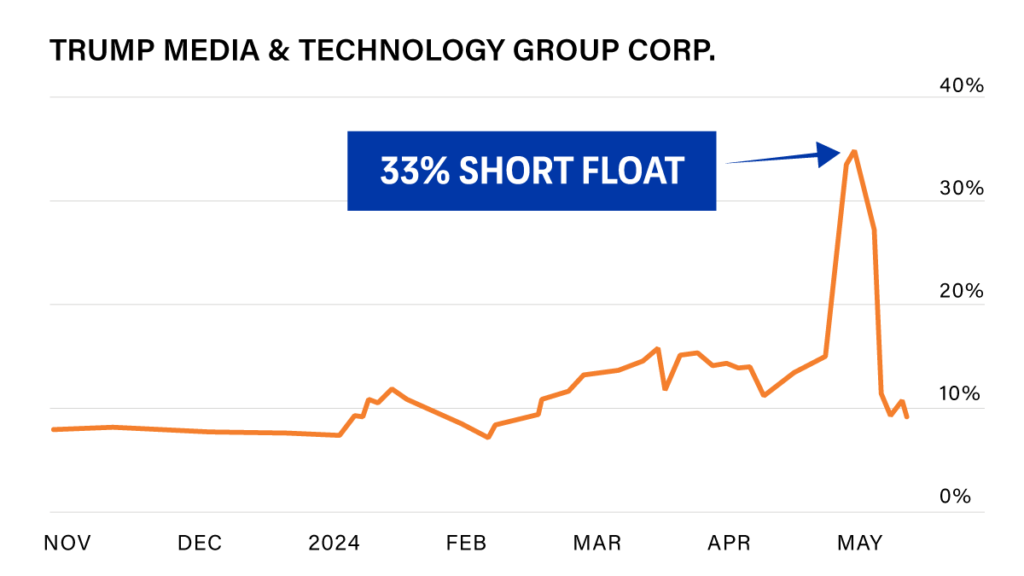

First, I’m scanning for stocks that investors are betting against. That means shares are heavily shorted. I like to see stocks with a high short float percentage. Float percentage is the number of shares sold short divided by the total shares of the stock. I’m looking for stocks with 20% short interest or higher.

Second, I’m looking for an overreaction from the market. Once I’ve found a high short float stock, I analyze its chart. If it has a bullish setup forming, we’re likely looking at an overreaction. That means, due to factors external to the stock itself (like election news), investors have over-shorted it.

Third, we set up our trade by buying some call options. Since these stocks are over-shorted, the market is expecting them to take a nosedive. As a result, their call options will often be rather cheap.

It really is that simple. Here’s how it works in practice…

A few months ago, former President Donald Trump’s legal drama and the overvaluing of his media company Trump Media & Technology Group (DJT) caused the market to over-short the company severely.

At its peak in May, the company had a 33% short float.

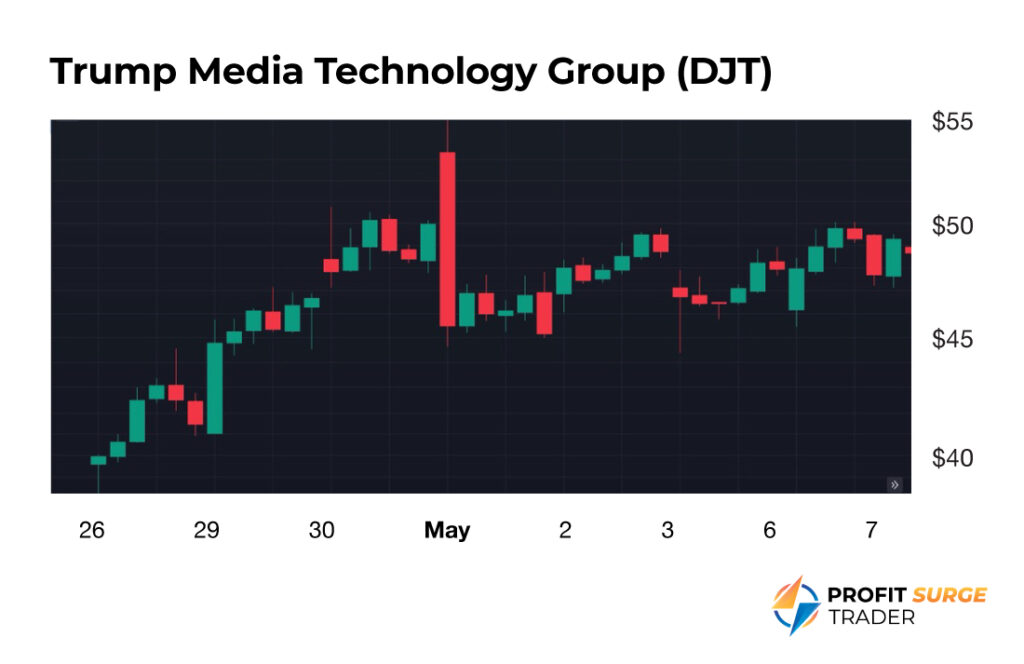

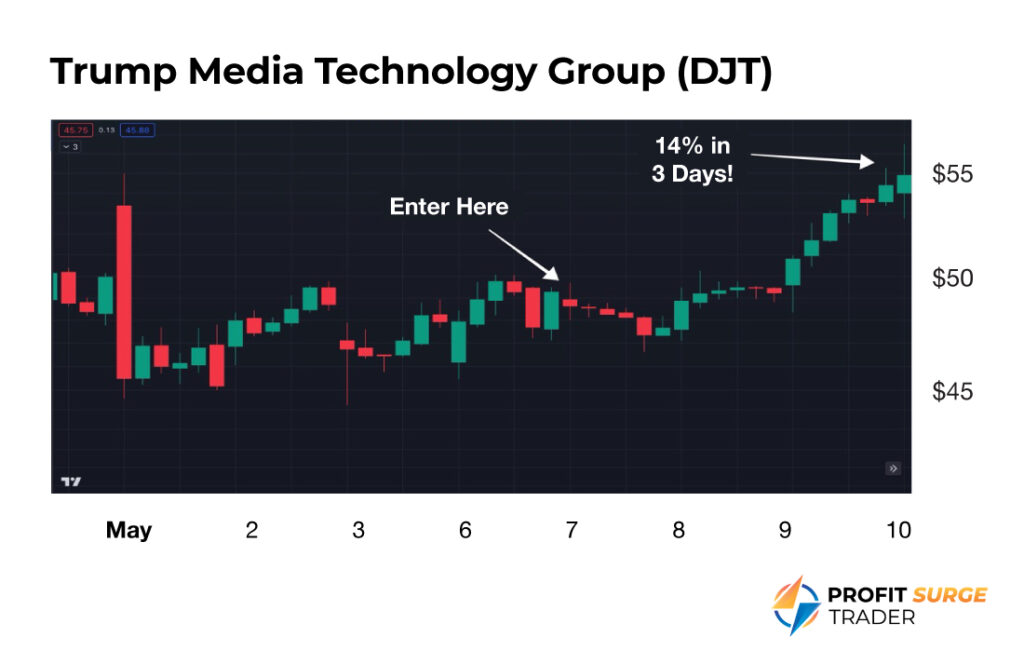

And the overreaction was obvious. You can easily see on the candlestick chart below where all those shorted shares were sold. Note the large red candlestick in the center of the chart…

That is the overreaction!

But notice what happened after…

People took a deep breath and the stock started to consolidate.

And if you would have gotten into the stock just a week after the panic…

You could have made up to 14% in just three days!

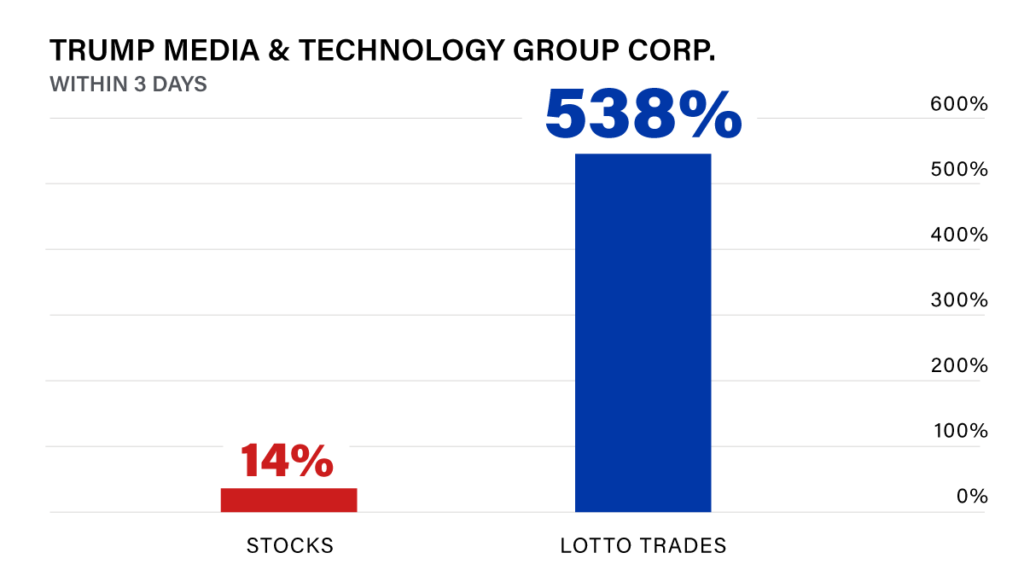

Now, making 14% in three days is incredible (that is more than an average year of S&P 500 returns)…

But it gets even better!

What I’ve mentioned thus far are the main criteria to find the perfect election stocks…

When I trade, I look to amplify my profits using options…

And when I find overreactions on high short float stocks…

“Lotto Trades” are my favorite trades to make.

These contracts are usually cheaper than $1, or $2 for large cap stocks. We also go for an expiration less than two weeks out.

These plays have 1,000%-plus gain potential.

In this theoretical play, we would have seen Trump Media make a big move with a $0.94 option and take home 538% in three days versus the 14% someone would have made playing the stock alone.

Now, despite the gain potential, you should not risk more than you can afford to lose on these plays. Just like you wouldn’t take out your 401(k) money to buy lotto tickets, don’t bet the farm on these plays. With options, a small investment goes a very long way.

We didn’t play Trump Media, but we have had members routinely rack up 400%, 500%, 600%, or more on these plays…

You Can Win Big, No Matter Who Wins in November

People are careless with their words, especially the news media. Words are cheap. But people are usually much more careful with what they do with their money. Even so, they often make irrational moves…

If you ignore what the media is saying, watch what people are doing with their money, and trade accordingly, you can vote yourself some more profits this year.

These Lotto Trade recommendations are reserved for my most dedicated students, and that includes you now. Welcome to the Profit Surge Trader chat room!

Legal Note: Nothing published by Monument Traders Alliance should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Monument Traders Alliance should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Monument Traders Alliance, LLC, 14 West Mount Vernon Place, Baltimore, MD 21201