Conventional investing wisdom would dictate that the smart strategy for making money is to set up a diversified portfolio with money spread out across several industries and companies…

But investors would be waiting years for that strategy to pay off… if it even pays off at all. Take the “trusty” buy-and-hold diversified portfolio of 60% stocks and 40% bonds, for example. In 2022, a model portfolio with that allocation experienced its worst performance since 1937.

In 2023, the market rebounded, but only a handful of stocks are responsible for that rebound. In fact, if it weren’t for Microsoft (MSFT), Google (GOOGL) and Nvidia (NVDA), the S&P 500 would have been down 2% last year.

Now, while the traditional buy-and-hold portfolio is still a good idea in the long run, its performance is likely to remain lackluster for the near future. So to make short-term gains, you should incorporate my “One Ticker Payouts” strategy.

This strategy is the polar opposite of a buy-and-hold strategy. But it’s every bit as simple and easy to use.

One Stock, One Month, Four Trades

The way my One Ticker Payouts strategy works is straightforward.

- Step 1: At the start of the month, I pick one stock that recently experienced a massive earnings surprise to the upside (or the downside in some cases).

- Step 2: I focus on that one stock over the course of the month as it reacts to the earnings surprise. And I look to trade it once per week.

- Step 3: Rinse and repeat.

Simple enough, but let’s break down each of those a little further…

Step 1: The Stock of the Month Club

Why do we look for a stock that recently experienced an earnings surprise? Wouldn’t we want to buy it before the earnings surprise?

Well, of course any investor would love to buy every stock before it announced a big earnings surprise. But this is a tough game to get right. And if earnings are poor, you can lose big.

Instead, I prefer to take a sure earnings winner and bet on it after the fact.

After the one-day share price pop due to a company’s earnings beat, many companies enjoy an “Earnings Profit Surge.” Stocks with the strongest reports will continue to move upward for weeks or even months.

Researchers from Harvard, Duke and the University of Cambridge have all proved this. Even the Federal Reserve and the Securities and Exchange Commission have studied the Earnings Profit Surge, and they found Earnings Profit Surges, or sharp rises in certain share prices over the course of several weeks, occur after an earnings surprise.

Harvard found that money flows into stocks after an earnings surprise due to retail investors driving the share price up for an extended period after the release. And a Duke study found that this strategy yields 18% more than normal stock trading on an annualized basis and that the results are even more extreme for initial public offerings.

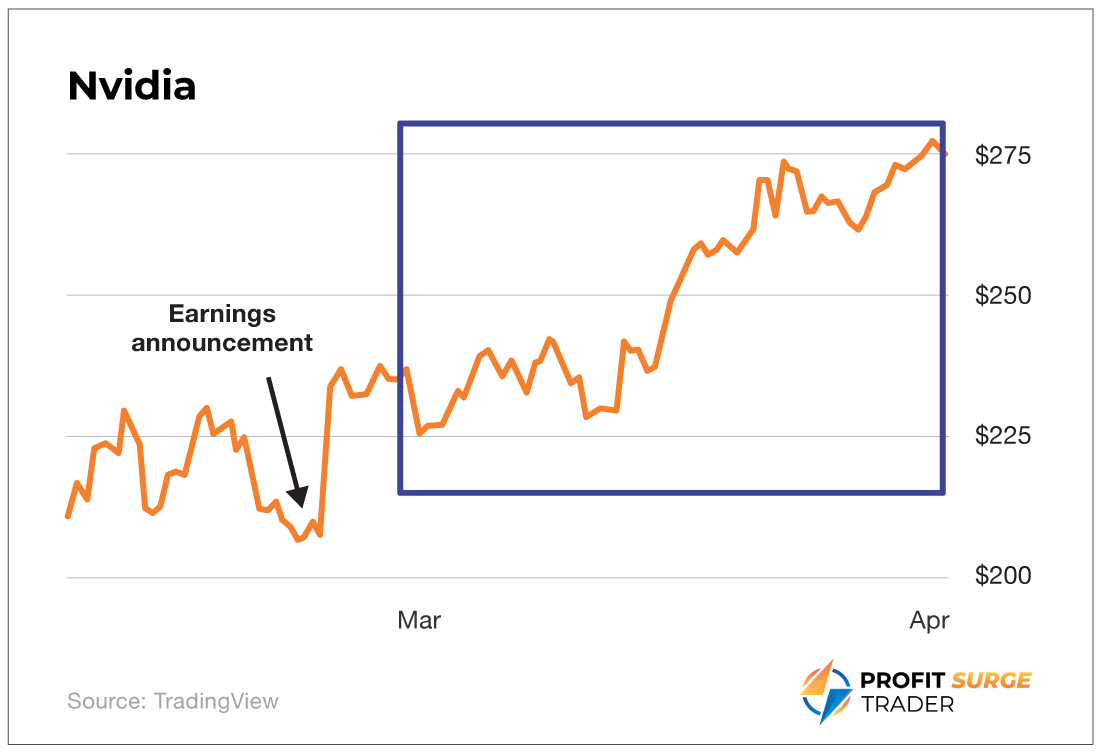

That’s what we’re trading on. Take a look at this Nvidia chart, and I’ll show you what I mean…

When Nvidia released its earnings at the end of February 2022, its stock saw a quick bump over the next couple of days. But after that initial climb, the stock continued rising until the end of March. It’s that upward swing that my strategy capitalizes on.

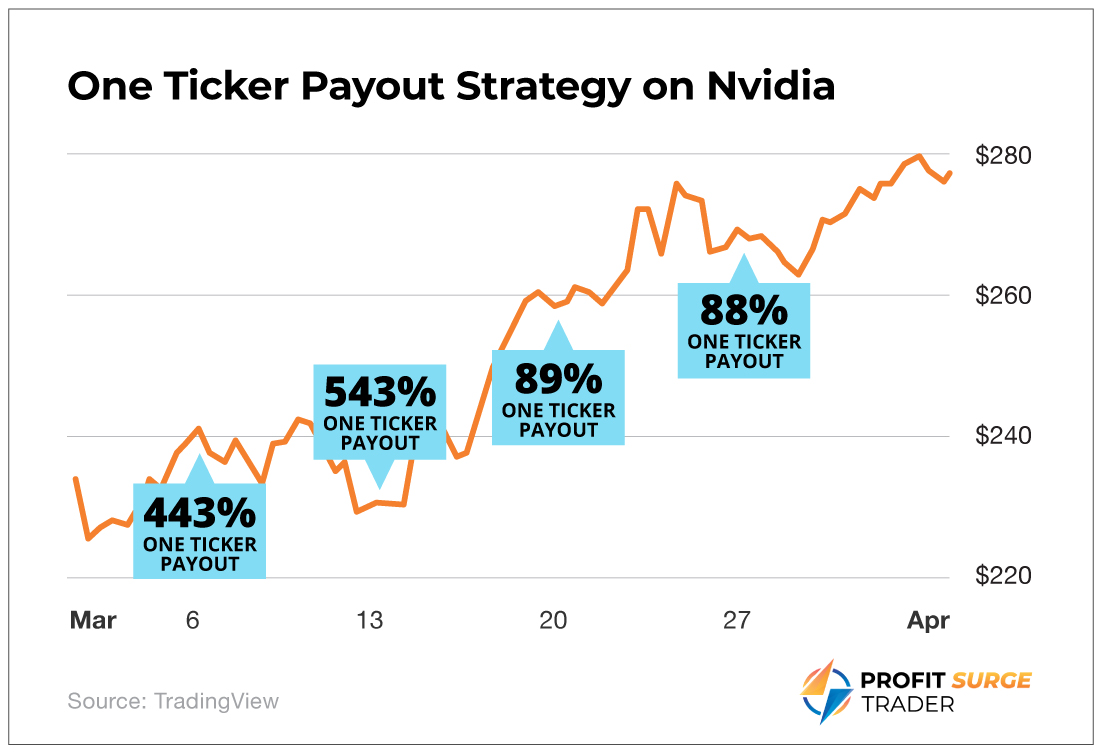

Using this strategy, we would’ve played Nvidia each and every week of the month with an option. And that strategy would have locked in a 443% return, a 543% return, an 89% return and an 88% return, one each week from the beginning of the earnings surge. Each of those wins was an options play, weekly options to be exact. (You can read more about them here.) But suffice it to say that someone playing just the stock would have taken home only a 35% gain.

All told, by making just one trade per week on that one ticker, you could have gone four for four on Nvidia. A $1,000 investment in each of those trades would have netted you $15,655 over the course of the month.

Step 2: You’ve Got Options

Now that you know what we’ll be doing, you need to understand the tool we’re going to be using to make our trades: options.

You can read more about what options are and the mechanics of how they actually work in my options guide, but for now, I’ll give you the short version.

An option is a contract that allows its holder to buy (calls) or sell (puts) shares of the underlying stock at a set price and time. An option essentially acts as leverage to magnify the upward or downward movement in a stock’s price.

Many investors are scared of options. They’re viewed as too risky and complex for everyday people. But just as with anything else, options are risky if you use them in the wrong way. But used correctly, they are no riskier than stocks. And they come with one big advantage over stocks in that they allow you to trade for higher potential gains while putting less money at risk.

See, an options contract represents 100 shares of its underlying stock. And buying an options contract is much cheaper than buying 100 shares upfront. Options offer greater, faster potential for gains.

I’m talking triple- or even quadruple-digit gains within just days. With stocks, that would be nearly impossible. But trading options correctly (like on an Earnings Profit Surge) can give you potentially massive gains.

We usually enter options trades once a week, often on Monday, which historically offers the lowest entry prices. That’s why I’m always looking to enter a new trade early in the week. And we will generally close it out in about eight days.

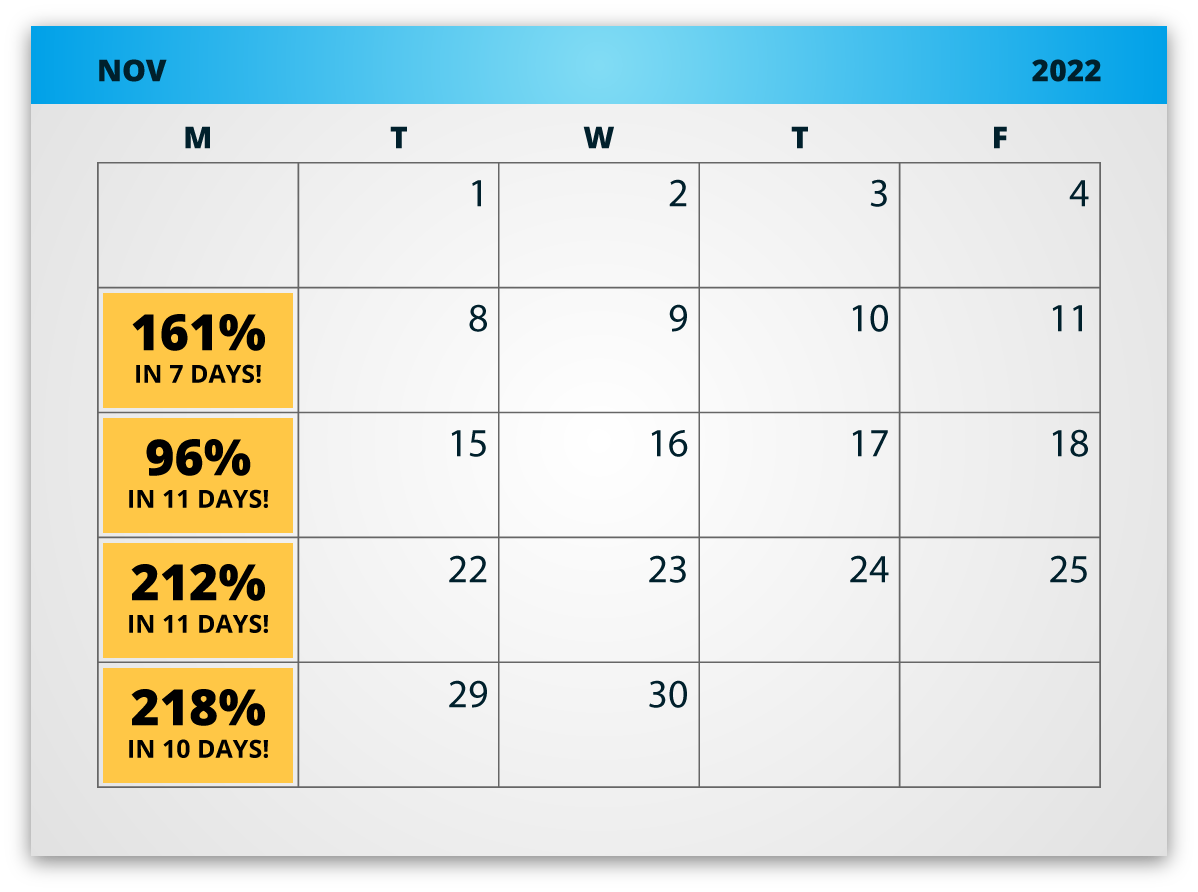

Here’s what that looks like on a calendar…

That’s a 161% gain in seven days…

A 96% gain in 11 days…

A 212% gain in 11 days…

And a 218% gain in 10 days…

An investment of $1,000 into each of these four trades could have turned into $10,895.

Now, that won’t be every month. Some months, I may not like any of the options on offer for a given week. And I won’t recommend an option to you if I don’t think it looks good. But the following week, we’ll likely either have options I like or have a whole new ticker to trade. There are 52 weeks in a year. That means 52 opportunities to profit from One Ticker Payouts.

And that’s not even the best part…

Step 3: Rinse and Repeat, No Matter What

The best part about this strategy is that it works in all environments, even when the market is down or not doing anything.

Because even in a down market, there’s always at least a handful of stocks going up…

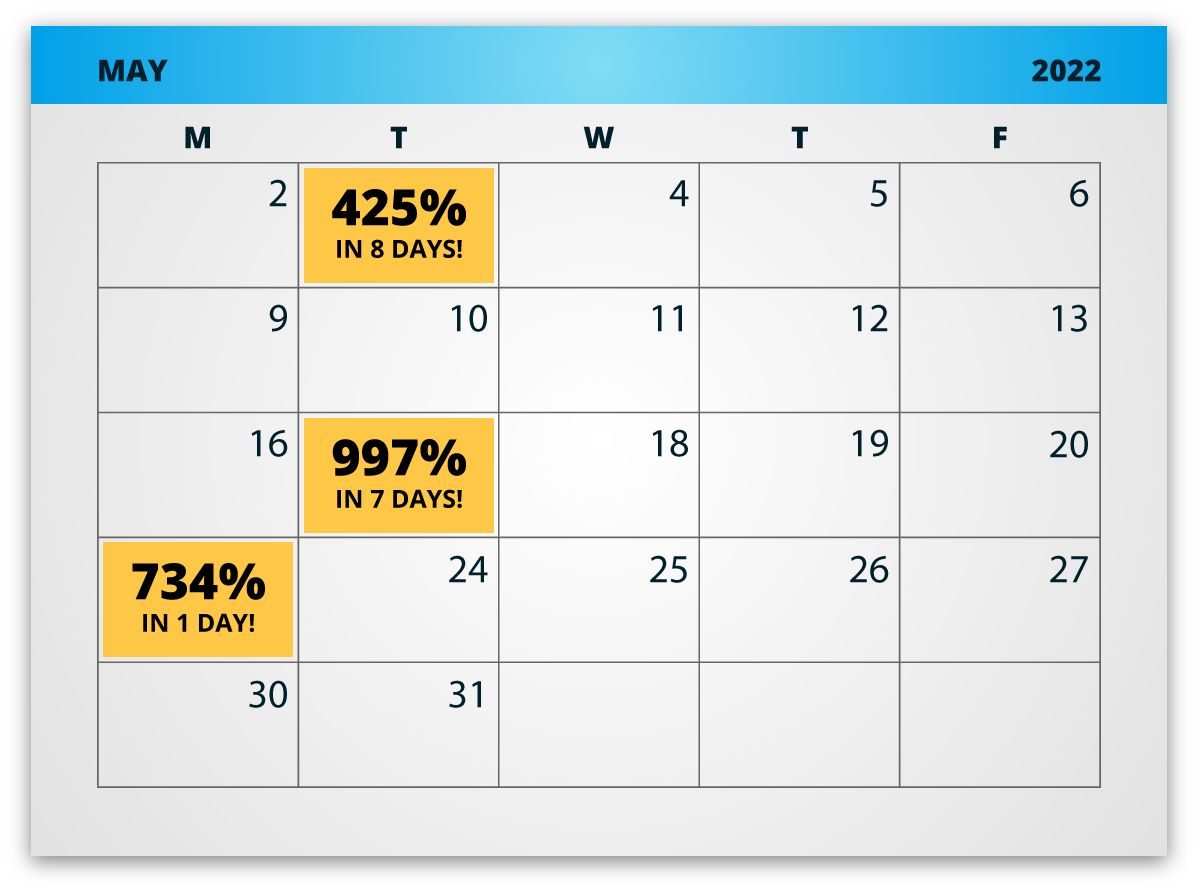

Look at the S&P 500 in May of last year. It grew 0.01%. That monthly return was closest to zero the S&P had seen in a single month since June 2006. Yet still my One Ticker Payout strategy could have worked wonders for investors.

The one stock to follow that month was Snap (SNAP).

It produced gigantic winners (of 425%, 997% and 734%) in three out of four weeks during that flat month.

No matter what the market does – even if we had market action that could destroy a traditional buy-and-hold portfolio – my One Ticker Payout strategy can capture gains. And you can catch a new trade every Monday…

One Ticker Payouts LIVE!

Every Monday, I will be broadcasting LIVE at 12 p.m. ET, and I’ll reveal my One Ticker Payouts game plan for the week.

I’m talking about…

- The exact ticker we’re trading

- The exact option contract we’re entering

- And most importantly, how we plan to exit the trade for our maximum payout.

Just 30 minutes or less… one day per week. And now you can tune in every Monday and trade alongside me right here.

Welcome to Profit Surge Trader!

Legal Note: Nothing published by Monument Traders Alliance should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We allow the editors of our publications to recommend securities that they own themselves. However, our policy prohibits editors from exiting a personal trade while the recommendation to subscribers is open. In no circumstance may an editor sell a security before subscribers have a fair opportunity to exit. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication. All other employees and agents must wait 24 hours after publication before trading on a recommendation.

Any investments recommended by Monument Traders Alliance should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company. Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Monument Traders Alliance, LLC, 14 West Mount Vernon Place, Baltimore, MD 21201